Las Vegas Sands Stock Upgraded as Macau Recovery Prospects Brighten

Las Vegas Sands received a significant upgrade from Jefferies analyst David Katz, who raised the rating to "buy" from "hold" with a new price target of $69, suggesting a potential 38% upside.

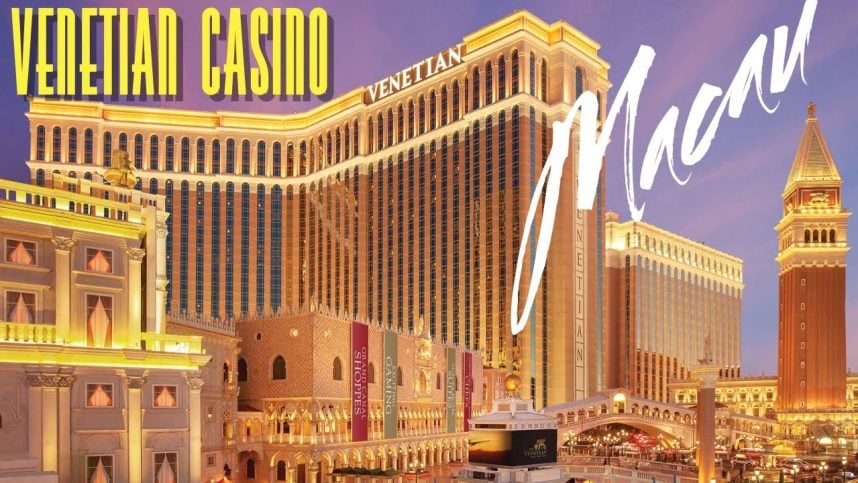

Macau Venetian casino lit at night

The upgrade is based on expectations of China's economic improvement and its positive impact on Macau's gaming market. Katz's analysis indicates strong growth potential, particularly in the mass market segment where Las Vegas Sands maintains significant exposure.

Key factors supporting the upgrade include:

- Projected return to pre-pandemic GGR levels by 2026

- Completion of Londoner Macau upgrades in H1 2025

- Potential benefits from Chinese monetary stimulus

- Strong positioning in mass and premium mass markets

The company's performance metrics are evaluated at:

- 20x earnings

- 12.5x price-to-free cash flow

- 11x enterprise value/EBITDA

Macau's gaming market showed resilience in 2024, generating $28.3 billion in gross gaming revenue (GGR), representing 24% year-over-year growth. Despite this growth, LVS stock gained only 4% in 2024, significantly underperforming the S&P 500.

In related news, Jefferies also upgraded Boyd Gaming (NYSE: BYD) to "buy" with a $92 price target, citing potential catalysts including:

- Norfolk, Virginia temporary casino opening

- Undervalued 5% stake in FanDuel

- Strong regional casino presence across multiple states

The market responded positively to these upgrades, with Las Vegas Sands gaining 1.04% and Boyd Gaming rising 1.52% on the news.

Related Articles

Sports Betting Legalization Efforts Fall Short Across Multiple States in 2024