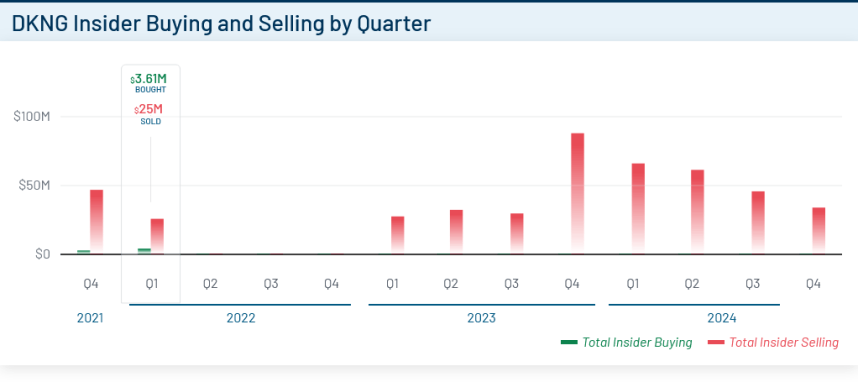

DraftKings Executives Unload $206M Worth of Company Stock in 2024

DraftKings insiders sold approximately $205.54 million worth of company shares throughout 2024, with sales declining each quarter. The year started with $66 million in Q1 sales, dropping to $61 million in Q2, $45 million in Q3, and finally $34 million in Q4. Recent significant transactions include sales by Chief Legal Officer R. Stanton Dodge and co-founder Paul Liberman, totaling over $30 million in December.

DKNG insider trading activity chart

The consistent selling pattern has raised concerns among investors, particularly as:

- All 20 insider transactions in 2024 were sales, with no purchases

- DraftKings stock only rose 5.53% in 2024, significantly underperforming major indexes

- Competitor Flutter Entertainment saw a 44.39% stock increase with no insider selling

This selling pattern contrasts sharply with DraftKings' competitors:

- Flutter Entertainment announced a $5 billion share repurchase program

- Caesars Entertainment saw less than $350,000 in insider selling

- Penn Entertainment insiders bought $2.61 million in shares while selling only $126,578

The stark difference in insider trading patterns and stock performance between DraftKings and its competitors has led to increased scrutiny from retail investors and market analysts.

Related Articles

Sports Betting Legalization Efforts Fall Short Across Multiple States in 2024